Presentation

Document presentation by the Beneficiary

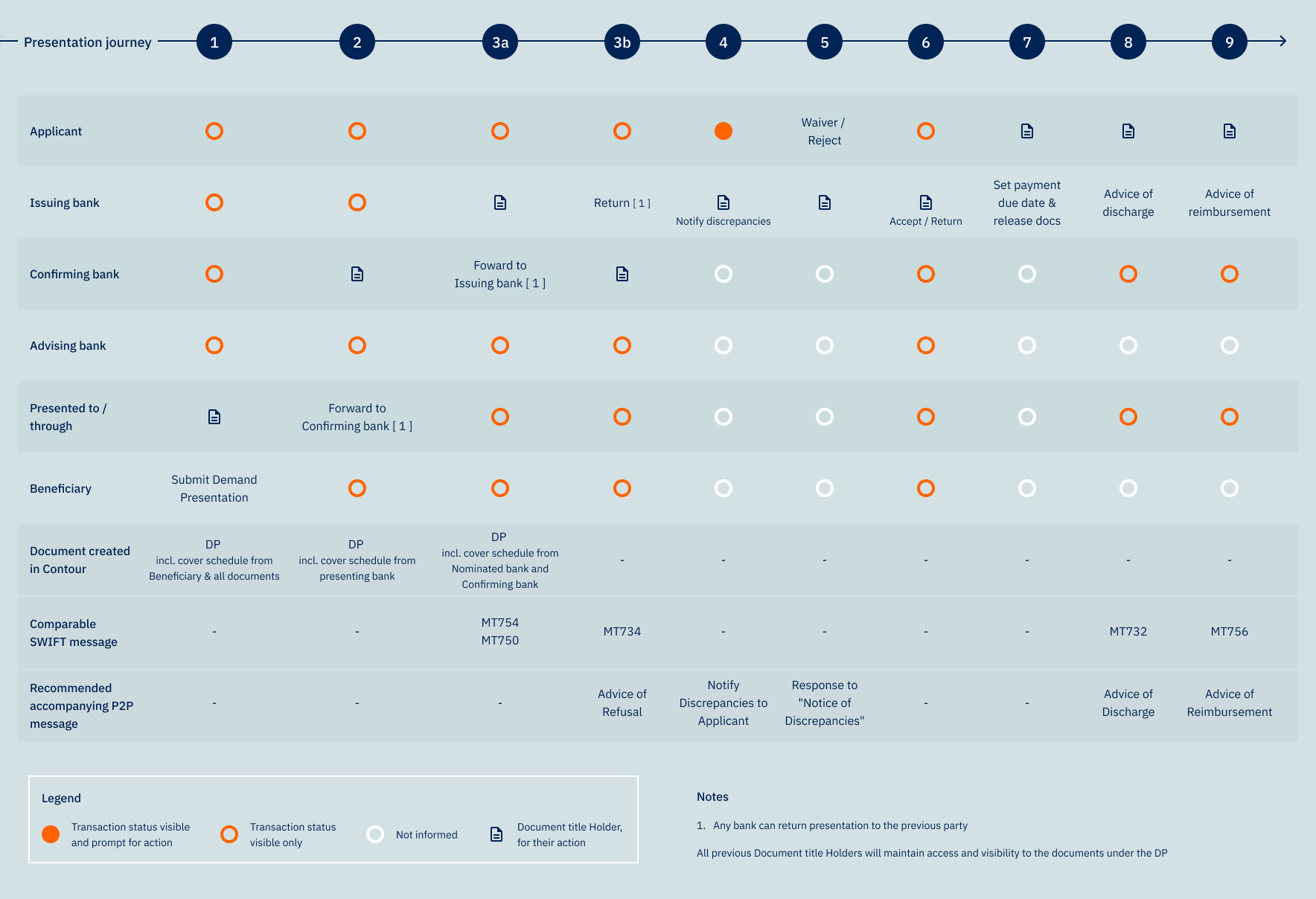

Once a DC is issued and advised, the beneficiary can present documents at any time. When creating a Document Presentation (DP) on Contour, the Beneficiary may choose the document source to be on Contour or other eBL providers. The Beneficiary can choose to present documents to the Nominated Bank, Requested Confirmation Party (if any), or the Issuing Bank. Additionally, the Beneficiary may also choose a presenting bank to present documents through, which could be the advising bank or any other bank on Contour. When presenting documents, the Beneficiary uploads the relevant documents stated in the DC form. Documents may also be mailed outside of Contour, should a physical copy of the documents be required.

Multiple presentations

In Contour, beneficiaries can submit multiple presentations, before the previous ones are accepted/rejected by the issuing bank.

Presenting Bank

If a presenting bank is mentioned in the presentation, then the DP is first sent to this bank. They can view the cover letter and all documents submitted by the beneficiary. The DP can be returned to the beneficiary if corrections are required. Otherwise the presenting bank forwards the DP. The DP is sent to the Nominated Bank.

Forwarding a DP is comparable to sending a SWIFT MT754 (Advice of Payment/Acceptance/Negotiation)

Nominated Bank

The nominated bank may forward the presentation to either the issuing bank or the requested confirmation party (if any), or return the presentation to the beneficiary (through the presenting bank, if any).

Requested Confirming Party

The requested confirming party may forward the presentation to the issuing bank, or return the presentation to the previous party.

Issuing Bank

Upon receiving the presentation, the issuing bank may accept the presentation, or return the presentation to the previous party. Once the issuing bank accepts the presentation, the issuing bank may set the payment due date and release documents to the applicant. The issuing bank may also set the payment due date first and release documents at a later date.

Discrepancy resolution

If there are any discrepancies, they may be notified to the applicant using P2P messages before accepting the presentation. The applicant responds to the message, with a waiver or an instruction to reject the presentation.

At this stage, the issuing bank may send an

Advice of Discharge(comparable to an MT732) to the paying/accepting/negotiating bank. This is done using a P2P message.

To indicate any reimbursement instructions, the issuing bank may also send anAdvice of Reimbursement(comparable to MT756) to the bank from which it has received documents. This is done using a P2P message.

Release to Applicant

The applicant can view and download the presented documents after they are released by the issuing bank.

At this stage, the document title has been transferred to the applicant and the presentation journey is completed.

At any stage, parties can interact with each other using P2P messages. These are tagged under the relevant DP for easy reference.