9.0 Release Notes

Version 9.0 introduces Contour Apply, a new feature that allows corporates to send Documentary Credit (DC) applications and amendment requests to the issuing bank, without requiring the beneficiary and their bank(s) to be on the network.

Along with Contour Apply, this release also contains new features and bug fixes as follows. It is recommended that you upgrade at the earliest date possible.

Contour Apply

Contour Apply enables DC applicants to send, manage, and track DC applications and amendments with Contour issuing banks. In these transactions, the issuing bank will issue the DC on SWIFT and the demand presentation workflow will not be available.

Benefits for Corporates

- Early Adoption: With this release, applicants and issuing banks can start using Contour without their full network being onboarded, allowing them to take advantage of the benefits of Contour's application, amendment, and messaging functionality immediately.

- Applicants will receive real-time status updates on the processing of their applications by their bank, keeping them informed at every stage.

- If the beneficiary is on Contour, corporate can collaborate in co-drafting the application, further enhancing the efficiency and accuracy of the process.

Benefits for Banks

- Single Window Solution: Banks can adopt Contour for their bank and all of their corporate clients, allowing the bank to receive all DC applications digitally through a stand-alone version of Contour, or from an imbedded version within their existing channel offering (will require integration with existing channel provider).

- Banks can co-draft the application with their corporate clients within Contour and process it outside the platform - issuing the Documentary Credit via SWIFT or paper, providing banks with flexibility in how they use Contour.

- Banks can provide real-time status updates on the processing status of trade applications, keeping applicants informed, reducing call centre volume, and fostering transparency.

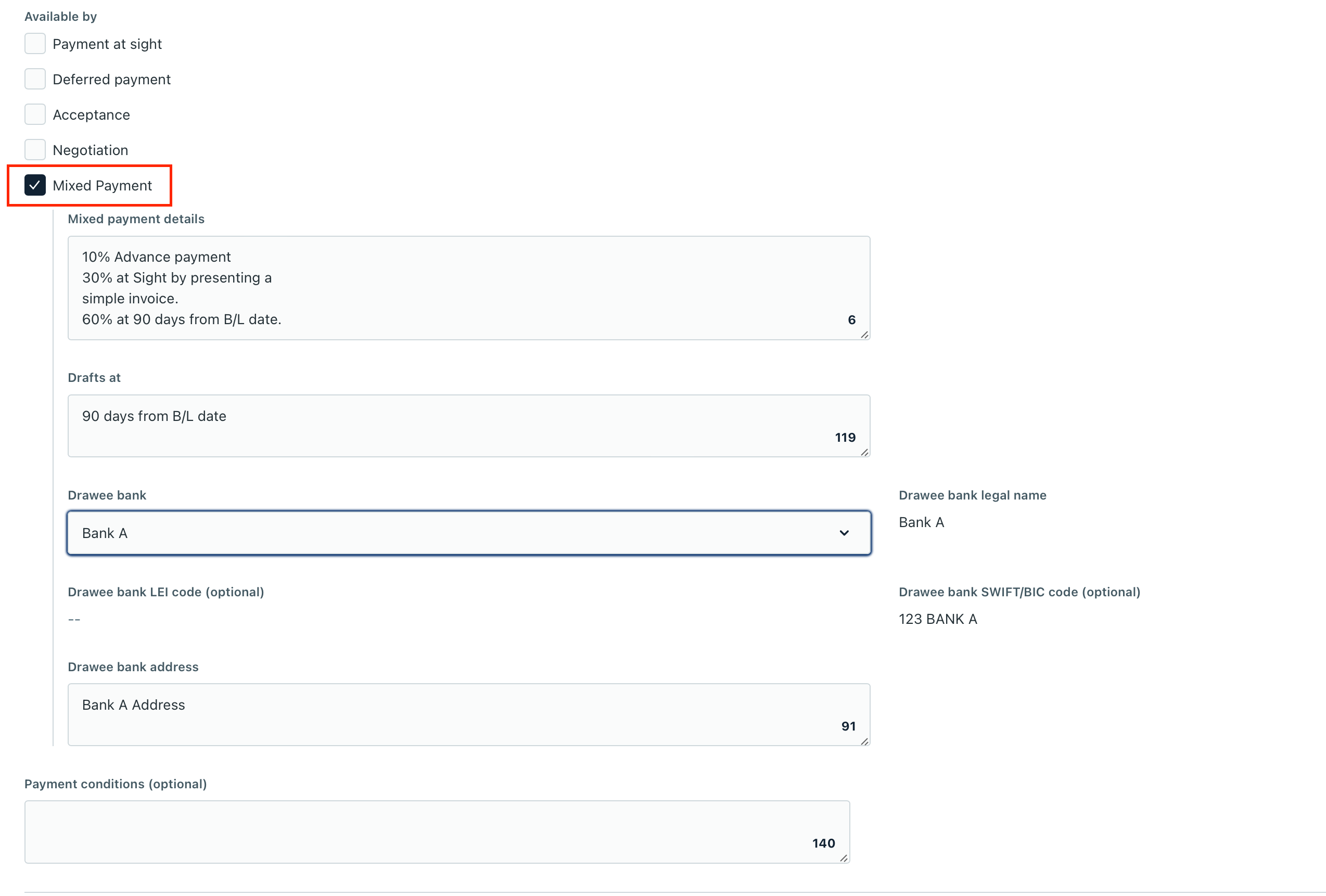

Mixed Payment

The corporates can now select Mixed Payment as one of the Available by options. This option specifies the payment dates, amounts and/or other requirements in a documentary credit which is available by mixed payment.

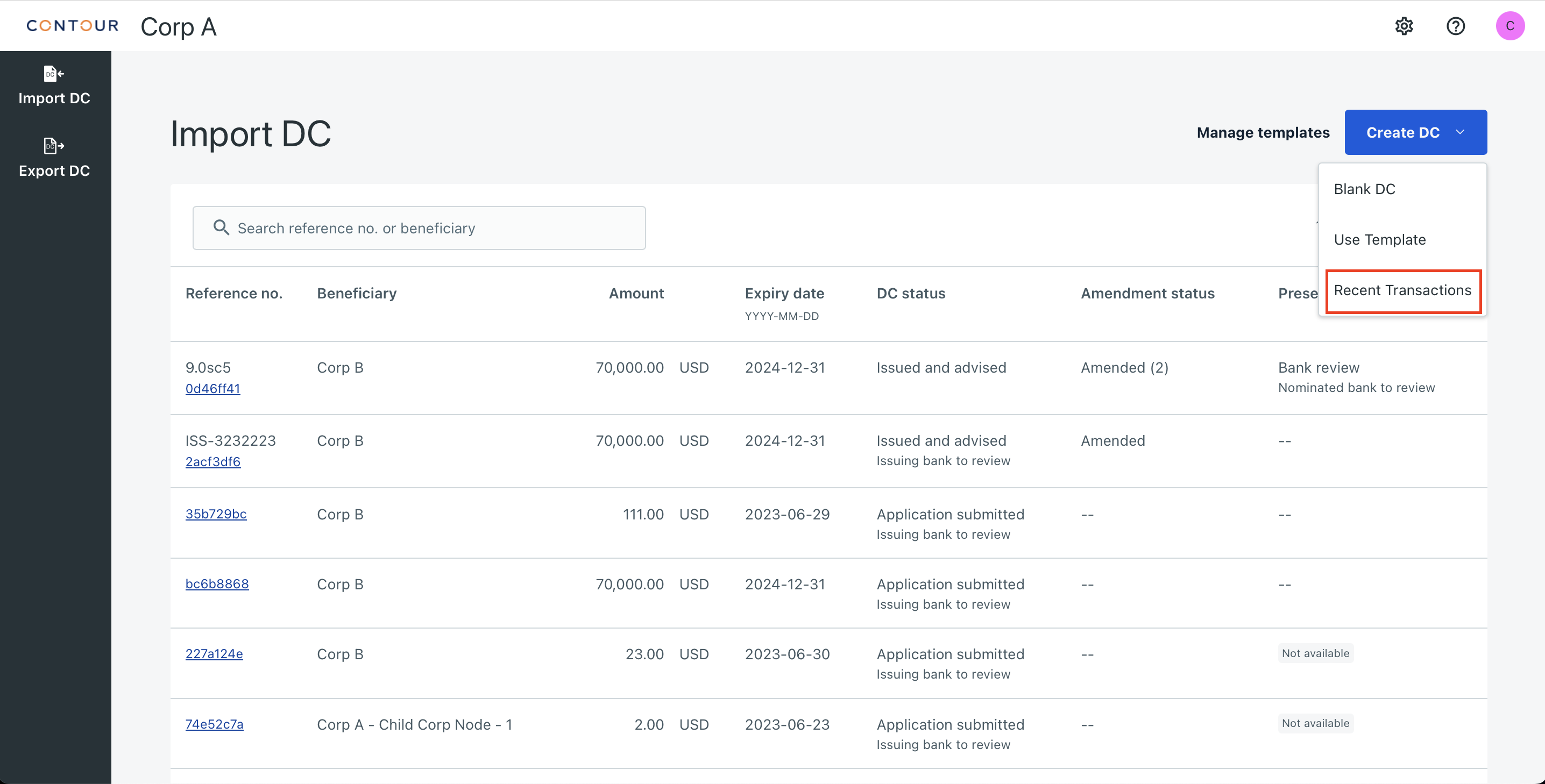

Recent Transactions

The corporates can now create a DC from a list of the last 10 DC applications completed within the last 60 days.

Bug fixes

Issues fixed in 9.0 are available here